- Home

- Course

- Business

- Accounting & Finance

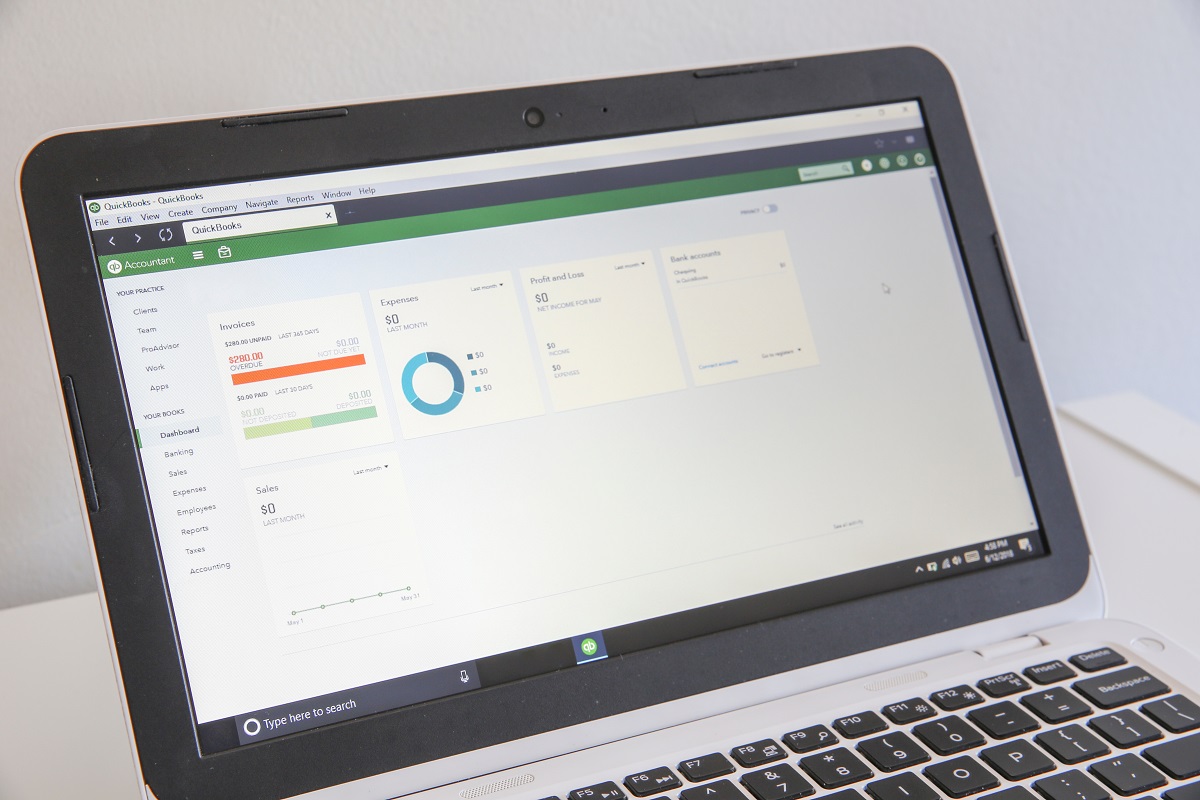

- QuickBooks Online Bookkeeping Diploma

- Overview

Educational accomplishments and income are closely correlated. Education and skill with endorsed certificates from credible and renowned authorities typically lead to better jobs with attractive salaries. Educated and skilled workers also have lower rates of unemployment. Therefore, skills and endorsed certificates to showcase are essential for people early in their careers.

- Why Choose Imperial Academy?

Imperial Academy offers this premium QuickBooks Online Bookkeeping Diploma course to ensure security in your career. In addition, this comprehensive QuickBooks Online Bookkeeping Diploma course will assist you in building relevant skills that will help you find a job in the related sectors. Also, the Certificate you’ll get after completing the QuickBooks Online Bookkeeping Diploma will put your head and shoulder above others in front of potential employers.

Become the person who would attract the results you seek. What you plant now, you will harvest later. So, grab this opportunity and start learning QuickBooks Online Bookkeeping Diploma!

- What Imperial Academy Offers You

- QLS/ CPD/ CIQ Accredited

- 24/7 Assistance from our Support Team

- 100% Online

- Self-paced course

- Bite-sized Audio-visual Modules

- Rich Learning Materials

- Developed by Industry Specialists

- Career Guidance

- Course Design

Learn at your own pace from the comfort of your home, as the rich learning materials of this premium course is accessible from any place at any time. The advanced course curriculums are divided into tiny bite-sized audio-visual modules by industry specialists with years of experience behind them.

- Audio-visual Lessons

- Online Study Materials

Course Curriculum

| Getting prepared - access the software and course materials | |||

| Set up free trial | 00:03:00 | ||

| Getting started | |||

| Starting A New Company File | 00:11:00 | ||

| Setting up the system | |||

| Enter opening balances | 00:02:00 | ||

| Reverse opening balances – accruals and prepayments | 00:06:00 | ||

| Report Journal | 00:05:00 | ||

| Nominal ledger | |||

| Amend The Nominal Ledger | 00:07:00 | ||

| Report listing the nominal ledgers | 00:02:00 | ||

| Customers | |||

| Enter customers | 00:09:00 | ||

| Report on customer contact information | 00:01:00 | ||

| Suppliers | |||

| Enter Suppliers | 00:05:00 | ||

| Supplier Contact List | 00:02:00 | ||

| Sales ledger | |||

| Enter Invoices | 00:09:00 | ||

| Invoice Entering | 00:03:00 | ||

| Invoice batch | 00:06:00 | ||

| Post Sales Credit Notes | 00:08:00 | ||

| Report showing Customer Activity | 00:03:00 | ||

| Aged Debtors | 00:02:00 | ||

| Purchases ledger | |||

| Post Supplier Invoices | 00:03:00 | ||

| Entering a Batch of Supplier Bills | 00:09:00 | ||

| Credit Notes Suppliers | 00:05:00 | ||

| Reclassify Supplier Bills – Flash Bulbs Purchased | 00:04:00 | ||

| Supplier Account Activity Report | 00:04:00 | ||

| Sundry payments | |||

| Post Cheques | 00:07:00 | ||

| Report showing supplier payments | 00:01:00 | ||

| Sundry receipts | |||

| Receipts from customers | 00:07:00 | ||

| Report showing customer receipts | 00:02:00 | ||

| Petty cash | |||

| Post Petty Cash Transactions and Report | 00:04:00 | ||

| Post cash payments to ledgers | 00:02:00 | ||

| Enter petty cash items | 00:14:00 | ||

| Report on Petty Cash Payments Proper | 00:05:00 | ||

| Post Sundry Payments | 00:05:00 | ||

| Report Bank Payments | 00:03:00 | ||

| VAT - Value Added Tax | |||

| VAT Return | 00:03:00 | ||

| Bank reconciliation | |||

| Reconcile The Bank | 00:10:00 | ||

| Provide A Report Showing Any Unreconnciled Transaction | 00:02:00 | ||

| Payroll / Wages | |||

| Post the Wages Journal | 00:08:00 | ||

| Posting Journal Adjustments | 00:02:00 | ||

| Reports | |||

| Month end adjustments | 00:03:00 | ||

| Month end reports | 00:06:00 | ||

| Tasks | |||

| Task- Crearing the accounts | 00:06:00 | ||

| Task – Customer report | 00:01:00 | ||

| Additional Resources | |||

| Course Paper | 00:00:00 | ||

| Further Reading – QuickBooks Online 2014 The Handbook | 00:00:00 | ||

Certificate of Achievement

Learners will get an certificate of achievement directly at their doorstep after successfully completing the course!

It should also be noted that international students must pay £10 for shipping cost.

CPD Accredited Certification

Upon successfully completing the course, you will be qualified for CPD Accredited Certificate. Certification is available –

- PDF Certificate £7.99

- Hard Copy Certificate £14.99

Related Courses

Course Info

- Accounting & Finance

- Business

- PRIVATE

- 1 year

- Number of Units43

- Number of Quizzes0

- 3 hours, 20 minutes

Recent Courses

Fixed Income Securities: Become a Bond Analyst & Investor

Overview Educational accomplishments and income are closely correlated. Education and skill with endorsed certificates from credible and renowned authorities typically …

- Business

- Employability

Xero Accounting and Bookkeeping Online Course

Overview Gain outstanding xero accounting and bookkeeping skills by learning xero operating fundamentals from our premium QLS endorsed Xero Accounting …

- Accounting & Finance

- QLS Endorsed – Single Course

Development

Development QLS

QLS Business

Business Healthcare

Healthcare Health & Fitness

Health & Fitness Technology

Technology Teaching

Teaching Lifestyle

Lifestyle Design

Design